Whenever world is in economical crisis or in boom period, a school thought start talking about decoupling of certain regions or countries from rest of the world saying that particular region is well protected due to certain reasons.

Many times in my previous postings I talked about the cent percent decoupling in present globalized is not possible. But to a certain extent a region or a country can be decoupled from the rest of the world only on

its own structural issues. Starting from present financial crisis we can take lot of examples where certain parts of the world are in crisis and other parts are not or not affectedly as badly as those. Now so called developed countries like US, UK, Japan, and majority part of Euro Zone are in the threat of double dip recession of deflation, where as BRIC (Brazil, Russia, China & India) countries, Australia and certain African countries are facing threat of Inflation or we can say they are reaching their previous growth trajectory.

India is on the high growth trajectory due to structural issues like domestic savings' pattern (which is of 33% to 35% compared with 2% of US), consumption oriented economy (60% of total country's GDP consumed within India), demographics (55% to 60% of the population is under the age of 26 years), cost effective nature of the companies (which applies to China also), fiscal schemes like

NREGS adopted by central government during the slowdown (rather than just monetary policies or so called quantitative easing which have limitation of after certain level like

liquidity trap or leakage of money supply due to

Interst Rate Parity). Now talking about Inflation which presently is the biggest threat to India's

real GDP growth, again due to structural issues like: sudden increase in expendable income of rural household due to NREGS scheme, non-efficiency of public distribution system (PDS) along with supply side problem due to uneven rainfall in certain parts of the country and as usual growth comes with some inflation. According to yesterday's

mint, IMF advised India to keep on hiking the interest to cool the inflation, an example of decoupling compared with problem facing countries'.

Now coming to China, the second fastest growing economy, as everybody knows its an export oriented country, but if it is only dependent on export oriented then it should have been in the same position that of US. But its not, in fact it is clicking double digit growth, due to:

1. Massive stimulus package of

4 trillion Yuan, they got from Chinese government of which they spent more than

80 percent, (i.e. more than 3 trillion Yuan on overall infrastructure, which is stepping stone for a country)

2. More than

9 trillion Yuan (more than double of government stimulus) loan disbursement of Chinese banks towards their countrymen lead to massive spending from Chinese towards their internal consumption.

3. Solid current account surplus of whopping $2.6 trillion due to continuous intervention in the forex market to keep Yuan undervalued to help the exporters.

And from inflation point of view, China is also facing similar kind of situation as that of India. Chinese real interest are deep in red due to as low as almost 2% deposit rate and about 5% inflation, which is again divergence from US, UK and Japan.

So similar respective things helped different countries domestically keep the growth momentum

--- Will be continued...

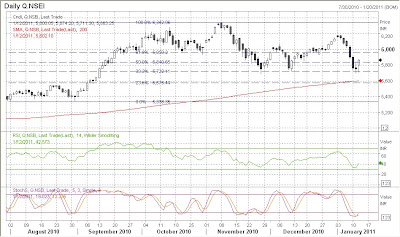

When Nifty started correcting from 6000 levels in November which is also 23.6% retracement level in Fibonacci retracement from top 6350 levels. From November Nifty started making bear market trend which is shown in the graph. At present that trend-line is ending at 5400 levels which is also 61.8% retracement level in Fibonacci and also Nifty has consolidated at this level for 2 months in July and August in 2010.

When Nifty started correcting from 6000 levels in November which is also 23.6% retracement level in Fibonacci retracement from top 6350 levels. From November Nifty started making bear market trend which is shown in the graph. At present that trend-line is ending at 5400 levels which is also 61.8% retracement level in Fibonacci and also Nifty has consolidated at this level for 2 months in July and August in 2010.